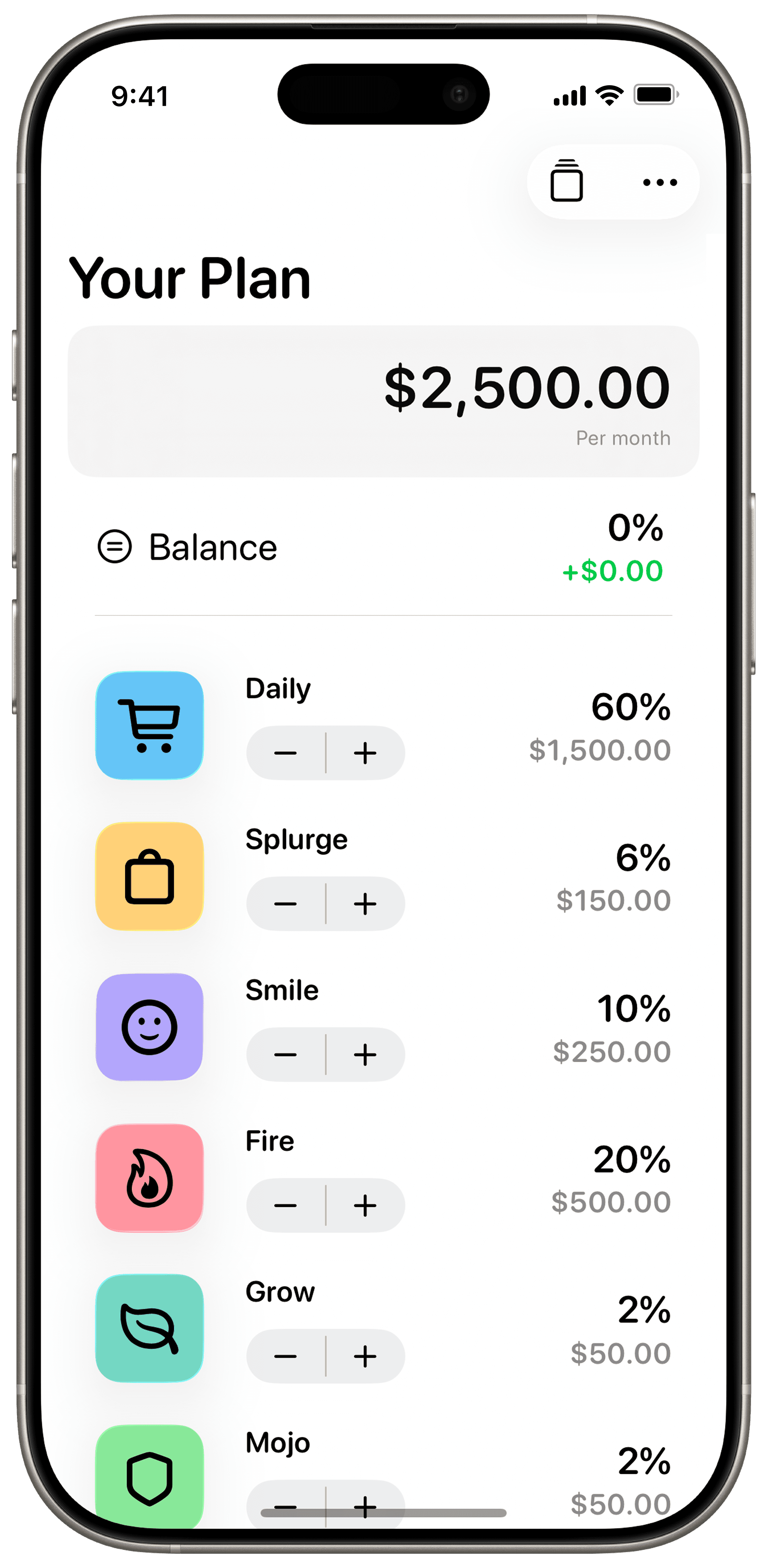

Barefoot Buckets

Get Barefoot Buckets

Split your take-home pay into buckets so each dollar has a clear job. Keep spending, goals, and debt progress in one place.

Add your monthly take-home pay.

Set bucket percentages that fit real life.

Track expenses, goals, and debt in the right bucket.

Check in monthly or on payday and adjust.

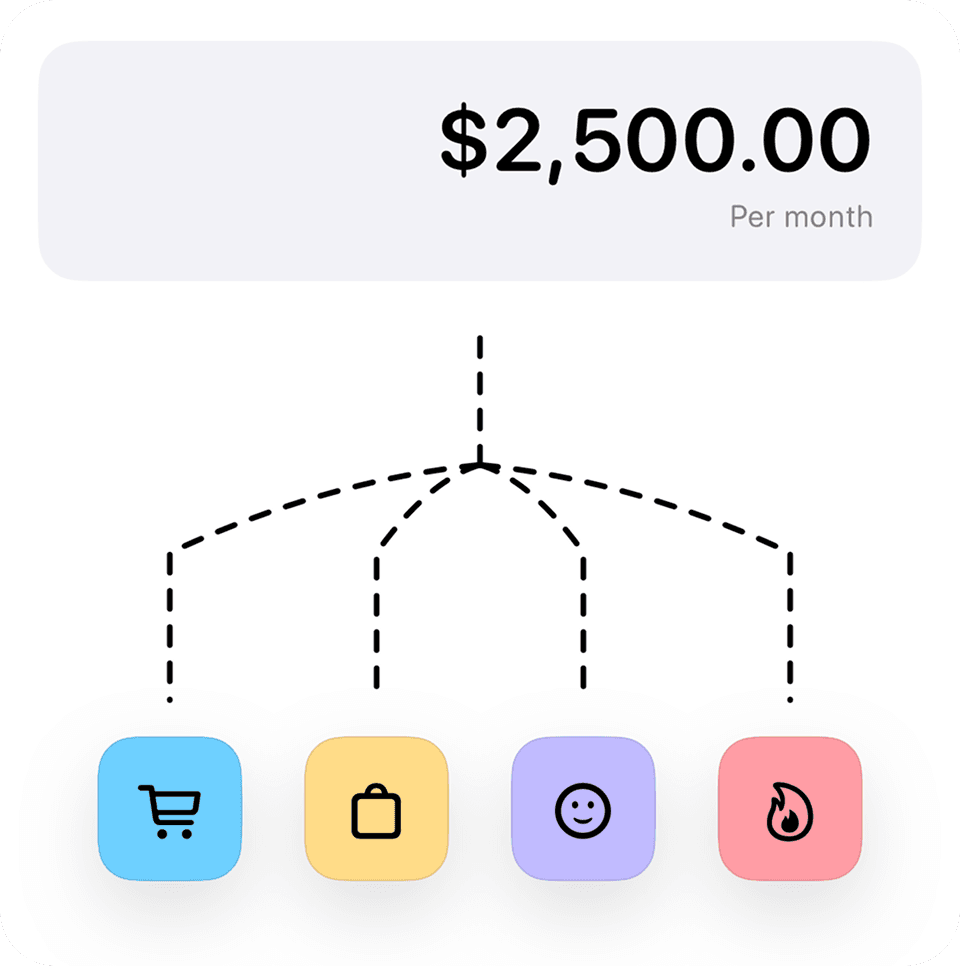

Think of buckets as money categories.

You can use defaults, or create your own.

Everyday living money. Bills, groceries, rent, mortgage, transport, and more.

Guilt-free spending for fun, treats, and little extras.

Save for goals that make you smile. Holidays, big buys, and experiences.

Extra repayments to pay off debt faster and put out the fires.

Your emergency buffer for peace of mind.

Long-term investing to build wealth over time.